How To File Jointly For Stimulus Check

File taxes to get stimulus checks. A couple filing jointly would not receive a stimulus check once AGI tops 174000.

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

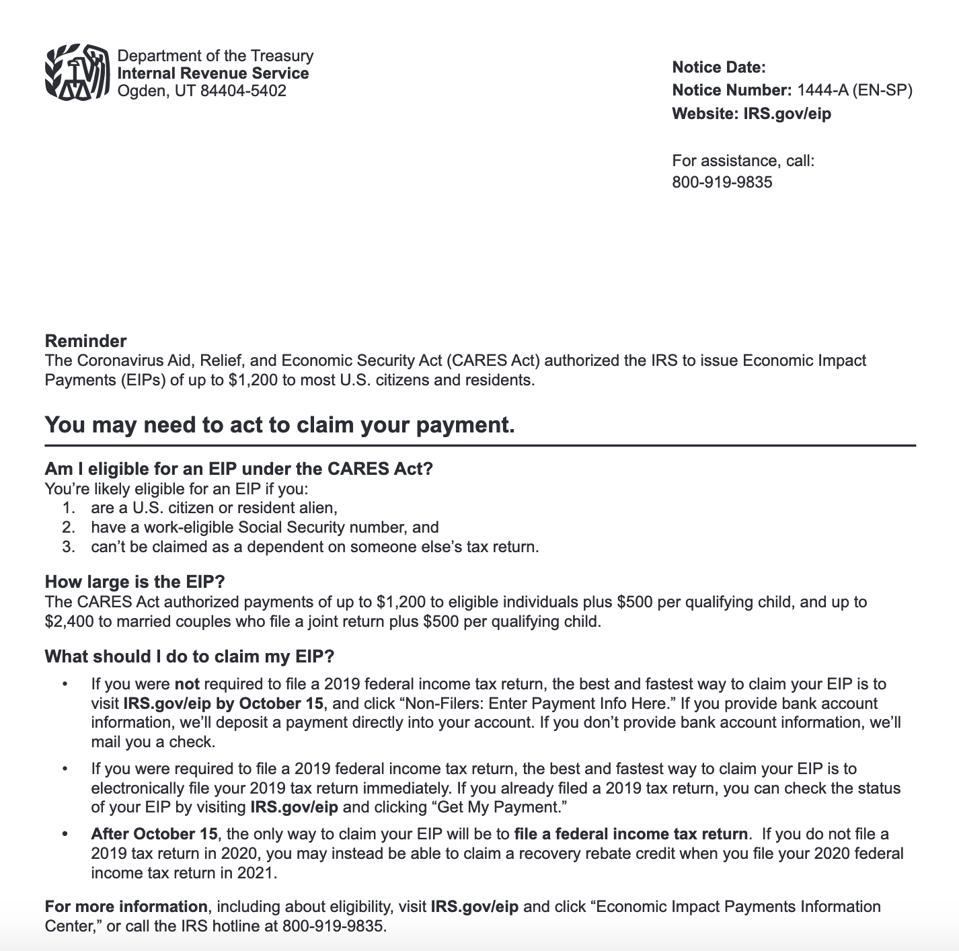

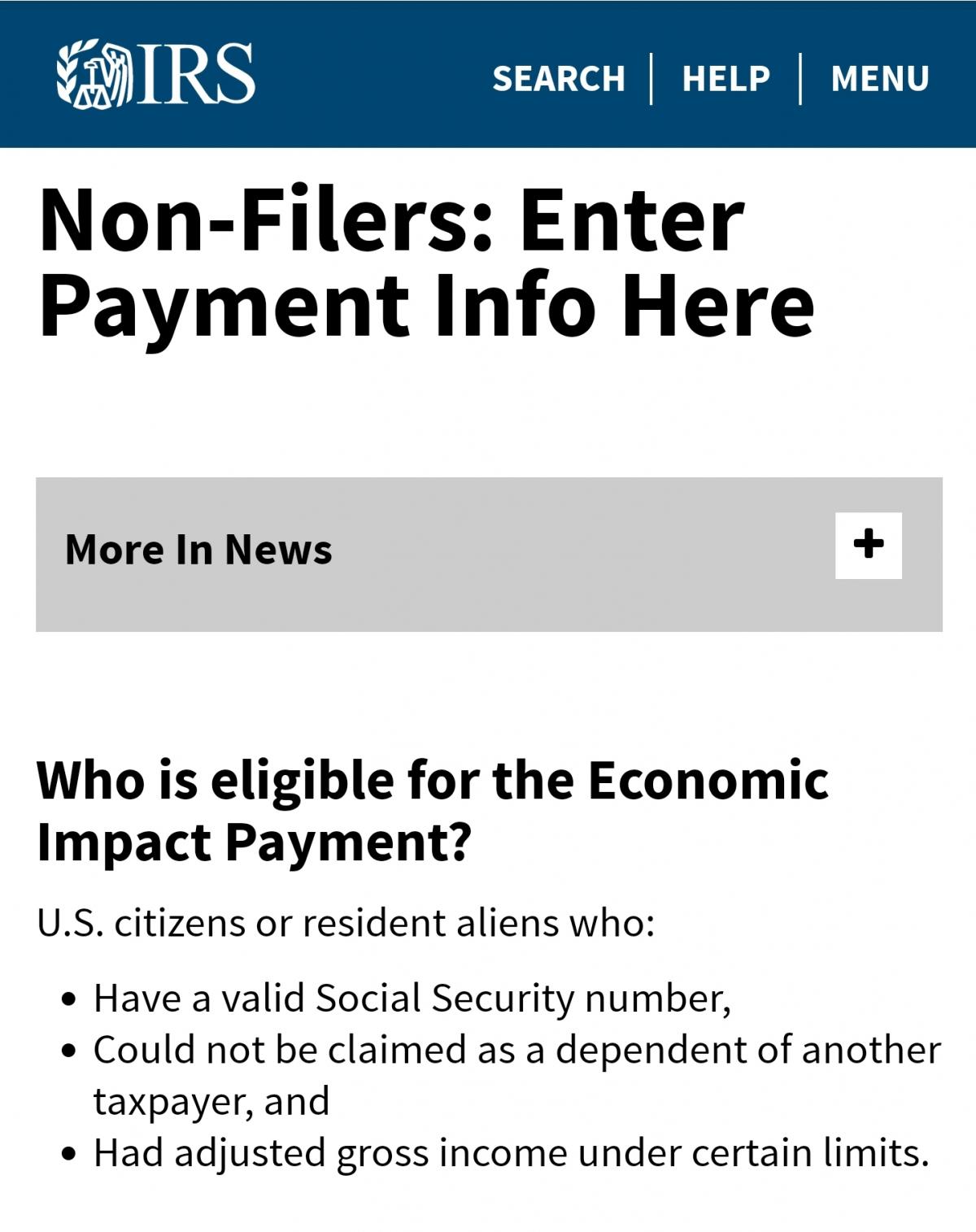

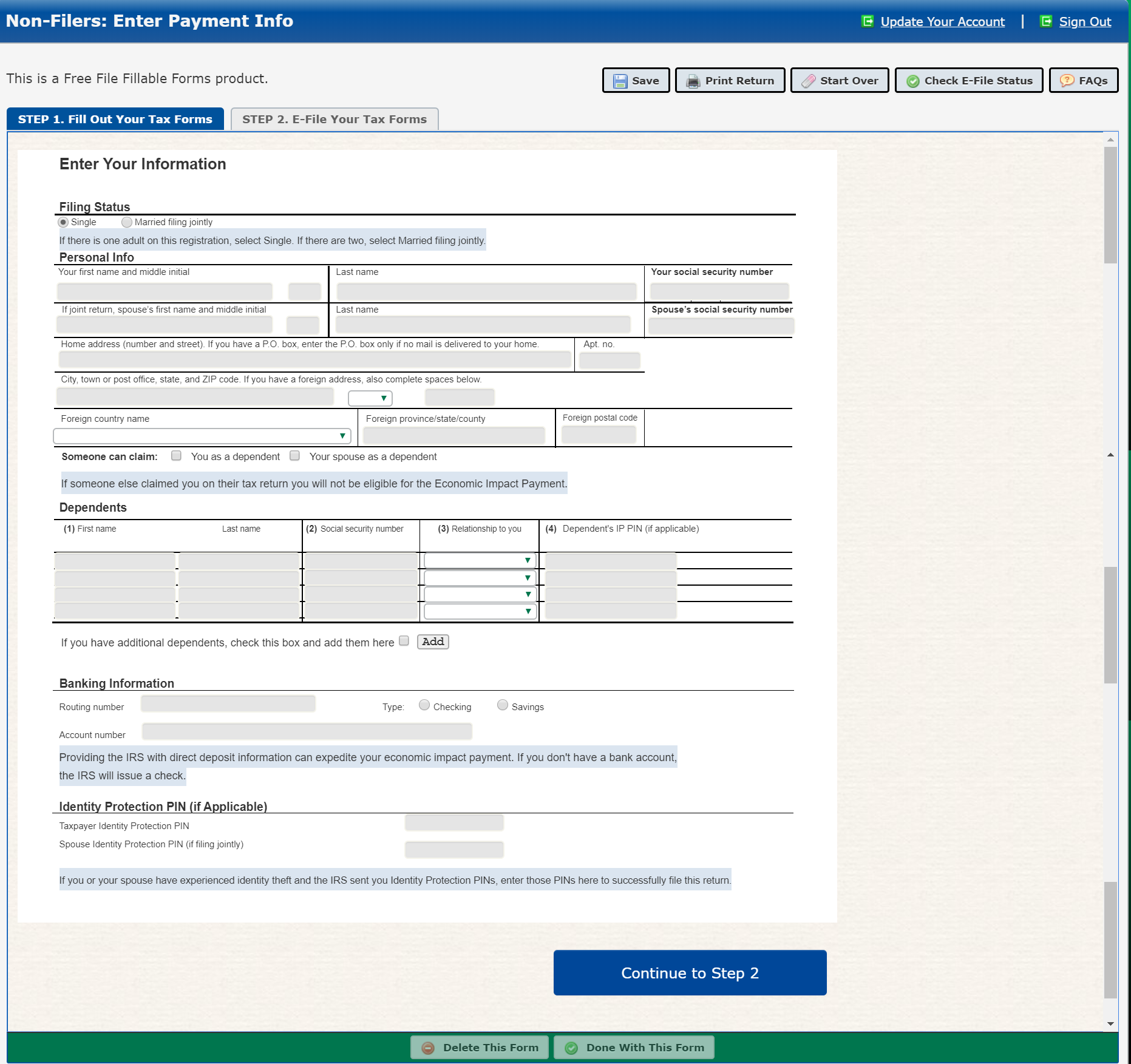

Non-filers have to take an extra step this year.

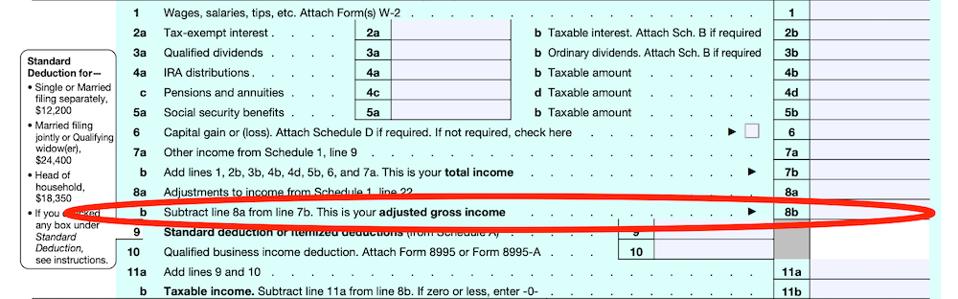

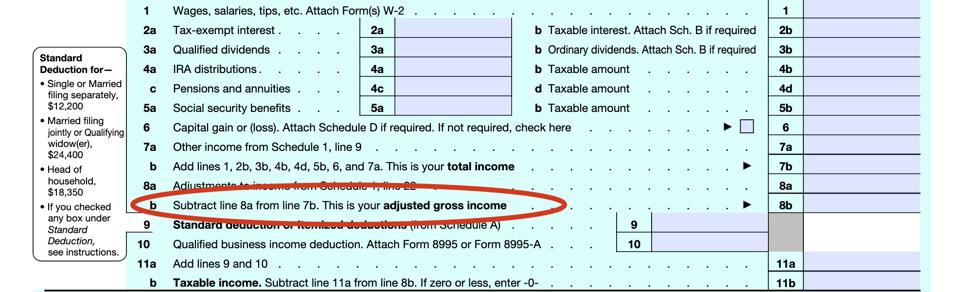

How to file jointly for stimulus check. You are eligible to receive the full payment if your adjusted gross income is below 75000 and a reduced payment amount if it is more than 75000 The adjusted gross income limit for a reduced payment is 99000 if you dont have children and increases by 10000 for each qualifying child under 17. It would have been nice for them to separate it though. For head of household filers the phaseout begins with AGI over 112500 and married filing jointly phaseout begins with AGI over 150000.

-If your household AGI. -If your household AGI. Couple filing jointly An AGI less than 200000 to qualify for any payment amount.

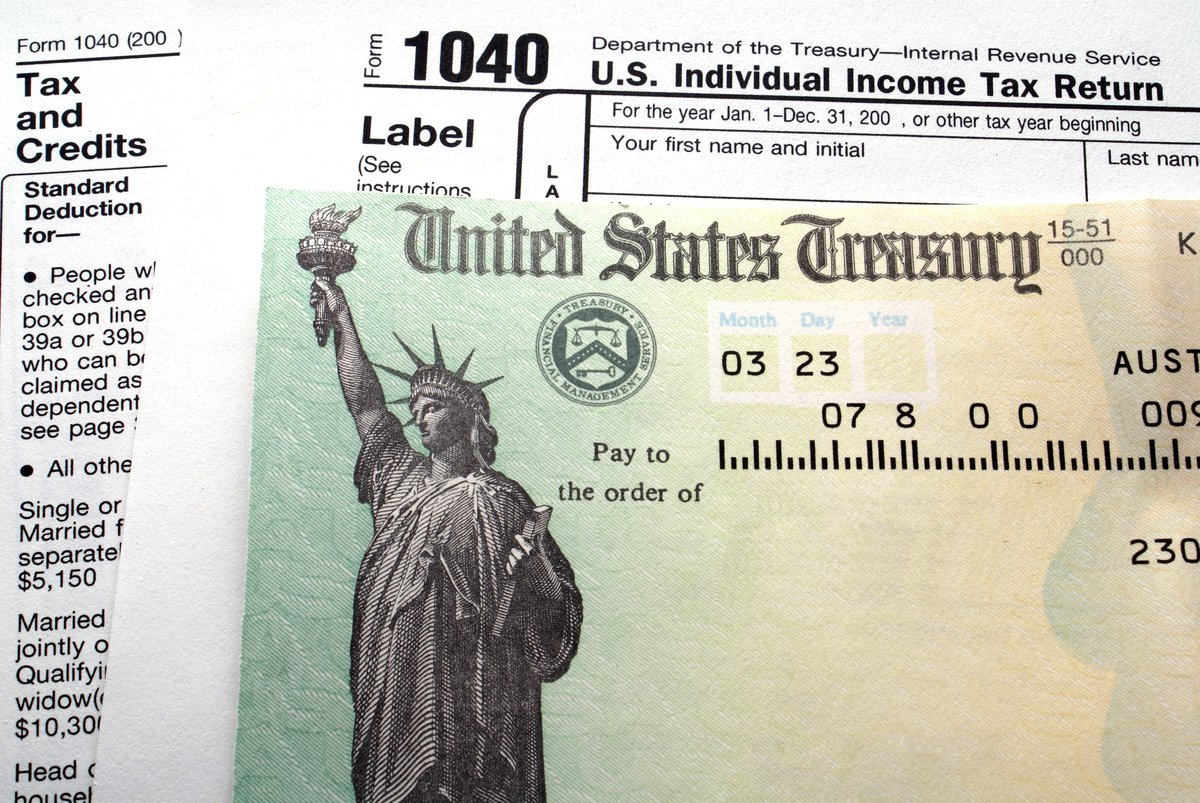

By filing a return this year the IRS will have your information on file going forward. The second round of stimulus checks is generally 600 for singles and 1200 for married couples filing a joint return. My husband and I filed jointly this year but had a federal refund deposit into separate accounts but the stimulus refund went into just his account.

They told me he has to file a 1040SA since. And then in the same post said Why when we file a joint return. I think they take the first account listed on the tax return for the stimulus check If you filed jointly.

The amount of the stimulus check is gradually reduced once AGI exceeds these limits. -If you are married filing jointly and have one child your maximum check would be 4200. Married couples filing jointly are eligible to receive a combined 2400 in stimulus money.

Some of your friends or relatives have received two COVID-19 relief stimulus payments in the past year. An individual either single filer or married filing separately with an AGI above 87000 would not receive a stimulus check. If your eligibility or situation changed such as a first-time filer you might find that youll receive additional stimulus money.

If you havent received anything yet and believe you should have dont fret. With the first stimulus check the IRS asked people to return the money for someone who had died since the previous tax filing. Customerreply replied 1 month ago.

Filing will help ensure that you get the third stimulus check. And a third may be on the way soon. Single or married but filing separately Head of a household Married filing jointly.

Married couples who file jointly and have an AGI. I am still a bit confused about yourand hubby tax filing status - because in the heading of your post you say Married filed joint return. To check how much your individual payment will be reduced use this Washington Post stimulus check calculator.

Individuals who had more than 75000 in adjusted gross income had their stimulus check reduced by 5 for every 100 of income and the same was true for married couples filing jointly with income above 150000. With the second check if your spouse died in 2020 and your AGI was. We dont file a tax return.

In addition those with qualifying children will also receive 600 for each. The Recovery Rebate Credit the formal name for stimulus checks reduces your overall tax bill and can result in a refund when you file. How to get your stimulus payments when you file your tax return.

Then you said in your initial post. -If you are married filing jointly and have one child your maximum check would be 4200. -If your household AGI was 160000 the check amount would decrease to 3360.

Customerreply replied 1 month ago. Check out the section below on how to claim the recovery rebate credit. And again at the end of this initial post.

That threshold jumps to 112500 for head-of-household filers and to 150000 for married couples filing a joint return. And if you have dependent children under the age of 17 listed on your tax return you can collect an. For people married filing jointly the cutoff for any payment is an AGI above 198000.

I wonder why we got one 1 stimulus check when we filed jointlywhy did we get 1 stimulus check for 60000 when we filed jointly thru turbo taxAny way to get check nowCan I get check now. Individuals who earned more than 99000 and couples who earned more than 198000 jointly did not receive checks. Ask Your Own Social Security Question.

Third-round stimulus checks will be completely phased out for single. Congress is set to pass legislation based on. -If your household AGI was 160000 the check amount would decrease to 3360.

Why You Should Set Up Direct Deposit With The Irs And Correct Errors Now Cnet

Why You Should Set Up Direct Deposit With The Irs And Correct Errors Now Cnet

Ssdi And Ssi What To Know About Stimulus Check Eligibility Catch Up Payments More Social Security Disability Disability Insurance Filing Taxes

Ssdi And Ssi What To Know About Stimulus Check Eligibility Catch Up Payments More Social Security Disability Disability Insurance Filing Taxes

Every Way Your Second Stimulus Check Payment Could Shrink Owe Money Money Filing Taxes

Every Way Your Second Stimulus Check Payment Could Shrink Owe Money Money Filing Taxes

The House Of Representatives Passed A Bill That Should Make For Profit Tax Filing Companies Very Happy The Tax Free Tax Filing Filing Taxes Best Tax Software

The House Of Representatives Passed A Bill That Should Make For Profit Tax Filing Companies Very Happy The Tax Free Tax Filing Filing Taxes Best Tax Software

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

Second Stimulus Check Frequently Asked Questions 11alive Com

Second Stimulus Check Frequently Asked Questions 11alive Com

How Non Filers Irs Can Receive Stimulus Check City Of Miami Springs Florida Official Website

How Non Filers Irs Can Receive Stimulus Check City Of Miami Springs Florida Official Website

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Third Stimulus Check For Dependents Every Change We Know Right Now Cnet

Third Stimulus Check For Dependents Every Change We Know Right Now Cnet

Despite 70 000 Furloughed Irs Workers White House Vows Refunds Will Be Issued Irs Filing Taxes Social Security Benefits

Despite 70 000 Furloughed Irs Workers White House Vows Refunds Will Be Issued Irs Filing Taxes Social Security Benefits

Stimulus Check Tax Credit Here S How To Get Your Missing Payment On Your 2020 Refund Filing Taxes Rebates Income Tax Return

Stimulus Check Tax Credit Here S How To Get Your Missing Payment On Your 2020 Refund Filing Taxes Rebates Income Tax Return

What To Know About The Economic Impact Payments Stimulus Checks Get It Back Tax Credits For People Who Work

What To Know About The Economic Impact Payments Stimulus Checks Get It Back Tax Credits For People Who Work

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

All You Need To Know About Round Two Of Covid Related Stimulus Checks

All You Need To Know About Round Two Of Covid Related Stimulus Checks

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

Stimulus Checks Unemployment Benefits And More Here S How The Pandemic Will Affect Filing Your Taxes Kxan Austin

Stimulus Checks Unemployment Benefits And More Here S How The Pandemic Will Affect Filing Your Taxes Kxan Austin

How Much Money Could You Get From The Coronavirus Stimulus Calculate Your Payment Here Nbc 5 Dallas Fort Worth

How Much Money Could You Get From The Coronavirus Stimulus Calculate Your Payment Here Nbc 5 Dallas Fort Worth

Post a Comment for "How To File Jointly For Stimulus Check"