Do I Need To File My 2019 Tax Return To Get Stimulus

Stimulus checks in 2020 were based on filers most recent tax return on file with the IRS either 2019 or 2018. But for those who havent filed their taxes yet theres an important thing to note.

Will The Stimulus Money Be Deducted From Your Refund Next Year Ktvb Com

Will The Stimulus Money Be Deducted From Your Refund Next Year Ktvb Com

If you havent filed your 2019 taxes the IRS will use the adjusted gross income AGI from your 2018 tax return.

Do i need to file my 2019 tax return to get stimulus. High income earners can claim the missing stimulus check amount as a claim tax credit on their 2020 income tax return. Only higher income earners need to include their stimulus check on their 2020 tax return and only as a tax credit. If a taxpayer doesnt file their 2020 tax returns before Congress passes its next relief bill the agency will likely rely on their 2019 tax return to calculate their stimulus check payment and.

In other scenarios it will behoove you to delay filing your 2019 return until AFTER youve. If you havent filed in either year but were required to file you should either file your 2018 or 2019 return as soon as possible. If your 2018 or 2019 returns showed too much income to be eligible for a stimulus check but your 2020 returns show an income below eligibility thresholds you also have to file a return to claim.

D should quickly file a 2019 return even with no income in order to generate a 1200 stimulus payment. If you didnt file your 2019 taxes they used information from your 2018 taxes. However if you made more in 2020 than you did in 2019 but you get a stimulus check before you file your taxes you may not be expected to return that money according to the latest proposal.

1 If you 2018 adjusted gross income AGI was above the EIP qualifying threshold and your 2019 AGI is now below the threshold or 2 you had. The stimulus check is an advance on a credit you can receive on your 2020 tax return. If a single taxpayer had 100000 of adjusted gross income for 2019 but only 75000 of adjusted gross income for 2020 for example he or she would be better off filing a 2020 tax return earlier.

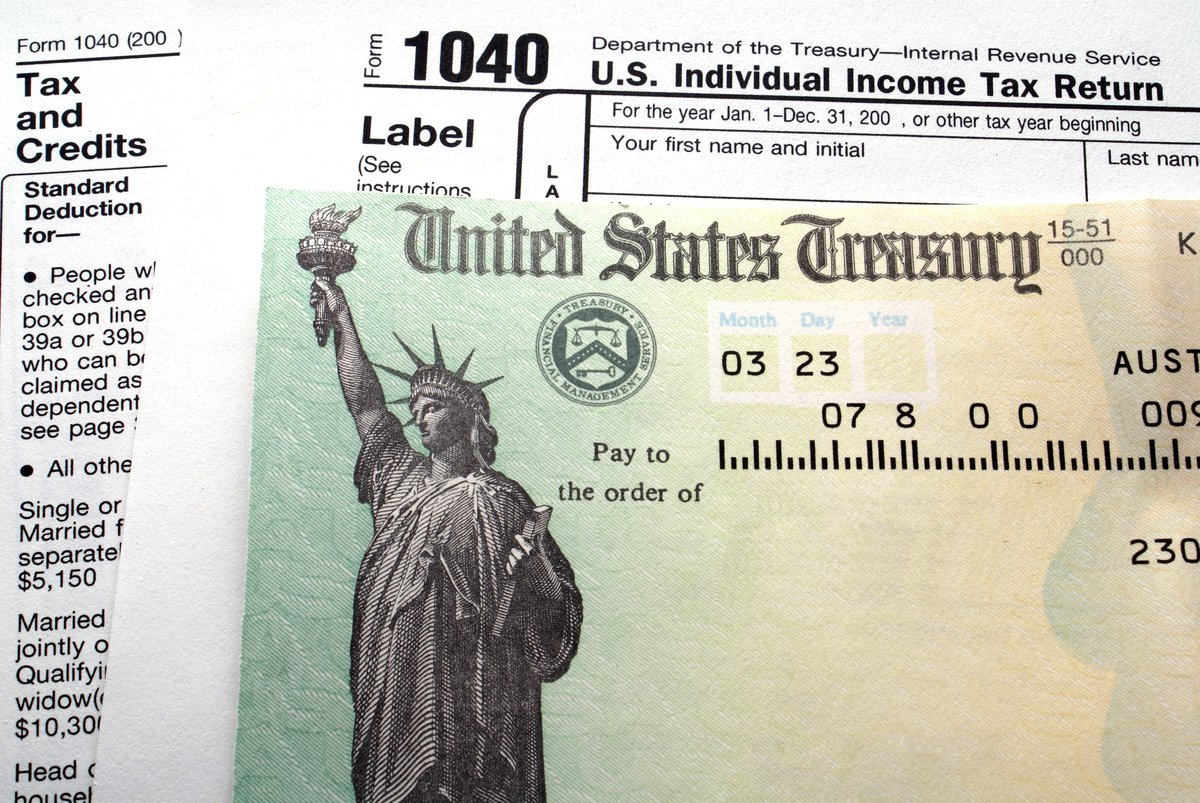

The IRS already began issuing stimulus payments based on your latest filed tax return 2018 or 2019. Youll need to file the standard 1040 federal tax return form or the 1040-SR tax return for people 65 or older to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund. Why you may be missing stimulus money.

If you filed a tax return in 2018 or receive Social Security income Railroad Retirement benefits Supplemental Security Income VA benefits or Social Security Disability Insurance SSDI you dont have to file your 2019 taxes to get a stimulus check also known as an economic impact payment or EIP. First check your two stimulus payments against your 2020 adjusted gross income as well as your family situation. If something went wrong or you did not get the stimulus check this year you can get it when you file your 2020 return in early 2021if you are eligibleIt will end up on line 30 of your 2020 Form 1040.

The first and second stimulus payments were based on your adjusted gross income as reported on your 2018 or 2019 tax return whichever the IRS had on file for you. Conversely if your income dropped in 2020 it. So if you made substantially more income in 2020 than in 2019 you might want to wait to file your returns until the stimulus payments are made.

If youre required to file a tax return and havent filed your 2019 taxes you may want to consider filing since you may be eligible for a tax refund. If you werent required to file a 2019 tax return because you were below income limits or you receive federal benefits such as Social Security including through SSI and SSDI programs you may. If you receive Social Security benefits either retirement or disability but didnt file a return in 2019 because you earn too little to be required to file youll also receive a stimulus.

Thats because the IRS based your two stimulus checks on either your 2019 or 2018. Last tax season about 72 of taxpayers received a tax refund and the average tax refund was close to 3000. However there are reasons you might want to.

Do not report it as earned income and if you received the full EIP payment do not include it at all.

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

8 Tax Myths To Avoid This Filing Season In 2020 Wealth And Power Tax Season Paying Taxes

8 Tax Myths To Avoid This Filing Season In 2020 Wealth And Power Tax Season Paying Taxes

Stimulus Payments Have Been Sent I R S Says The New York Times

Stimulus Payments Have Been Sent I R S Says The New York Times

Stimulus Check Qualifications Fine Print Income Limit How The First Payment May Impact The Next Relief Package In 2020 Tax Deadline Prepaid Debit Cards Supplemental Security Income

Stimulus Check Qualifications Fine Print Income Limit How The First Payment May Impact The Next Relief Package In 2020 Tax Deadline Prepaid Debit Cards Supplemental Security Income

Irs To Launch Online Tool For People To Track Their Stimulus Checks Wjhl Tri Cities News Weather Irs Website Irs Payment

Irs To Launch Online Tool For People To Track Their Stimulus Checks Wjhl Tri Cities News Weather Irs Website Irs Payment

Tax Premier On April 29 2020 Possible Text That Says Receiving Yo

Tax Premier On April 29 2020 Possible Text That Says Receiving Yo

Third Stimulus Check For Dependents Every Change We Know Of Right Now Cnet

Third Stimulus Check For Dependents Every Change We Know Of Right Now Cnet

When Will You Get Your Stimulus Check Irs Launches Tracking Tool Tax Refund Income Tax Filing Taxes

When Will You Get Your Stimulus Check Irs Launches Tracking Tool Tax Refund Income Tax Filing Taxes

600 Stimulus Check Didn T Get A Payment Or The Full Amount 10tv Com

600 Stimulus Check Didn T Get A Payment Or The Full Amount 10tv Com

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York Tax Refund Irs How To Get Money

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York Tax Refund Irs How To Get Money

Third Stimulus Checks And Tax Season Faq Why Things Could Get Messy Cnet

Third Stimulus Checks And Tax Season Faq Why Things Could Get Messy Cnet

Stimulus Check Status Social Security Disability Benefits Pay Chart In 2020 Social Security Disability Benefits Social Security Disability Disability Benefit

Stimulus Check Status Social Security Disability Benefits Pay Chart In 2020 Social Security Disability Benefits Social Security Disability Disability Benefit

Forget Stimulus Payments Many Are Asking The Irs Where S My Refund Irs Irs Website Filing Taxes

Forget Stimulus Payments Many Are Asking The Irs Where S My Refund Irs Irs Website Filing Taxes

Stimulus Checks And Your 2020 Taxes What You Need To Know When You File Cnet

Stimulus Checks And Your 2020 Taxes What You Need To Know When You File Cnet

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

Nonfilers And Stimulus Checks What You Need To Know If You Never File Taxes Cnet

Nonfilers And Stimulus Checks What You Need To Know If You Never File Taxes Cnet

2020 Stimulus Check Amounts And Income Thresholds Visual Ly Income Filing Taxes Thresholds

2020 Stimulus Check Amounts And Income Thresholds Visual Ly Income Filing Taxes Thresholds

Second Stimulus Check Frequently Asked Questions 11alive Com

Second Stimulus Check Frequently Asked Questions 11alive Com

Post a Comment for "Do I Need To File My 2019 Tax Return To Get Stimulus"